13th/14th Salary

The Complete Guide

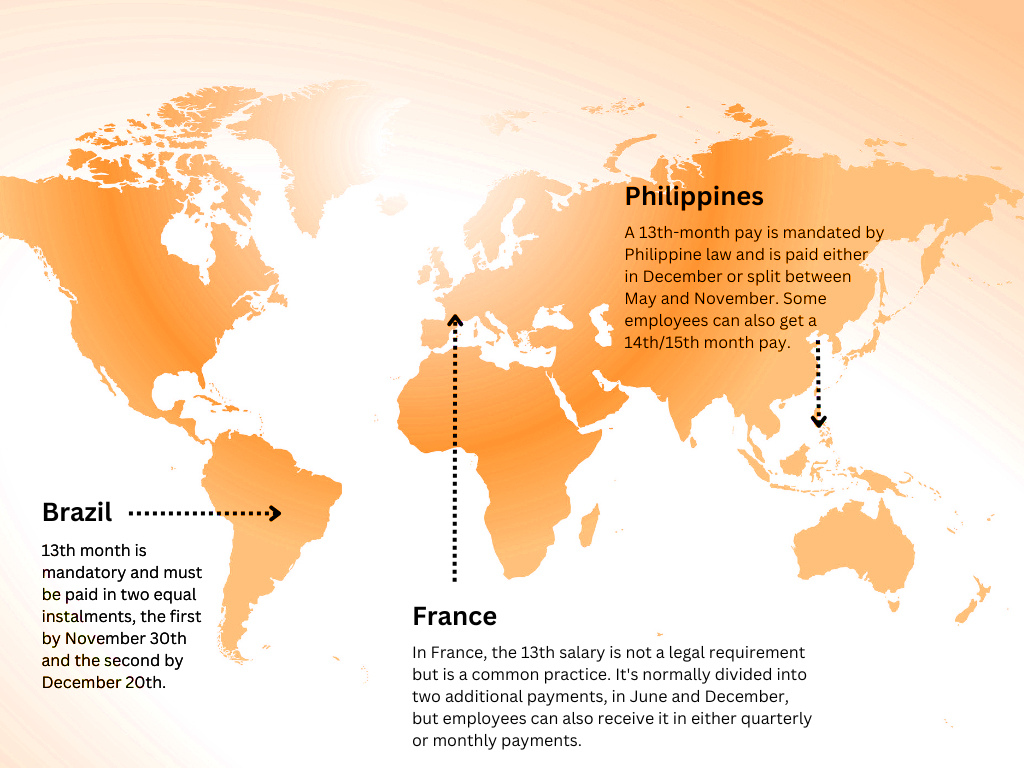

When branching out to employment in a new territory, it’s likely you’ll encounter some unfamiliar payroll jargon, including the terms 13th and 14th salary payments. Whilst only mandatory in 25 countries worldwide, it’s customary to include these in an additional 30 countries’ employment contracts. Here’s everything you need to know.

What is 13th/14th salary?

13th and 14th salary payments are a form of additional compensation, accrued throughout the year, then traditionally paid out in one or two instalments in June and December. The usage of 13th or 14th salary must be considered when considering an employee’s salary, as this will affect the cost to the employer. These additions can be voluntary, discretionary, or mandatory payments to supplement the usual monthly pay, and are typically only offered to salaried employees, excluding contractors, freelancers, and zero-hours employees. As these are increasingly common across the globe, it’s important to know what this means as an employer if you’re looking to hire through a Professional Employer Organisation (PEO).

How is it calculated?

13th and 14th salary are calculated in several ways, but the most popular is by dividing an employee’s annual salary by 12 and paying this monthly figure as an additional amount.

- Annual salary/12 = 13th salary payment

Another common method is to divide the annual salary by 13 (or 14), so the additional compensation is still taken from the annual base salary, rather than being a bonus amount.

- Annual salary/13 = 13th salary payment

The method of calculation used will likely affect the base salary offered to the employee, so this is worth checking!

Where is it mandatory?

The table below shows countries in which 13th or 14th month salary are mandatory in every industry, however Austria, Belgium, Cyprus, France, and Germany all mandate 13th salary by industry.

Europe

| Armenia | 13th only, paid before New Year holidays |

| Greece | Paid in June, December, and an additional bonus for Easter |

| Italy | Paid in June and December |

| Portugal | Paid in June and December |

| Spain | Paid in June and December |

Latin America

| Argentina | 13th only, split between June and December |

| Bolivia | 13th is tax free, 14th paid as mandatory bonus only if GDP over 4.5% |

| Brazil | 13th split across November and December, 14th paid in January |

| Colombia | 13th only, split between June and December |

| Costa Rica | 13th only, paid in December |

| Dominican Republic | 13th only, paid in December |

| Mexico | 13th only, paid in December |

| Ecuador | 14th mandatory, can be paid in one lump sum or in parts across the year |

| El Salvador | 13th, paid as Christmas bonus |

| Guatemala | 13th and 14th, paid in June and December |

| Honduras | 13th in December, 14th in July |

| Nicaragua | 13th only, paid in December |

| Panama | 13th paid in 3 parts in April, August, and December |

| Peru | 13th and 14th, paid in July and December |

| Uruguay | 13th, paid in two halves in June and December |

| Paraguay | 13th only, paid in December |

| Venezuela | 13th only, paid in December |

Asia

| India | 13th only, paid within eight months of the end of the financial year |

| Indonesia | 13th only, as religious holiday bonus (Tunjangan Hari Raya) |

| Philippines | 13th, paid either in December or split between May and November; additional 14th and 15th may be added |

| Saudi Arabia | 13th only, paid on Eid |

Africa

| Angola | 13th and 14th, as a vacation bonus and in December as Christmas bonus |

| Nigeria | 13th only, paid in December |

| South Africa | 13th only, paid in December |

How is 13th month salary different to a bonus?

Whilst 13th month salary may seem like a bonus, it’s not considered to be one, as it isn’t determined by employee or company performance. It’s historically used instead to supplement employee salary at specific times throughout the year, particularly holiday periods. There are also differences in how 13th month salary is taxed in comparison to bonuses, as performance-based bonuses may not be taxable in some countries.

How is 13th salary taxed?

In most cases, 13th and 14th salaries are subject to the usual income taxes, the same as all normal salaries. However, this varies between countries, with some only applying tax once a threshold is reached. As well as changes in taxation, some countries may also have different employers’ costs on 13th and 14th salary payments.

How can a PEO help?

If you’re unfamiliar with 13th and 14th salary payments or you’re unsure how to handle them in a new market, a Professional Employer Organisation (PEO) can provide valuable support. A PEO can advise you on the local laws and regulations regarding 13th and 14th salaries and help you manage the administrative and tax-related aspects of these payments.

By partnering with a PEO, such as Gibson Watts Global, you can ensure that your business complies with local payroll laws and regulations and avoids any penalties or fines. Contact us today to find out more.