Business in the UK:

5 Industries to Keep an Eye On

The business landscape is shifting rapidly. The pandemic has drastically increased the need for certain sectors, whilst reduced the dominance of others. 2020 saw huge change as, the majority of businesses had to take drastic measures to adapt to the new environment. While some of these measures are temporary, many looks set to be implemented permanently. Going into 2021, whilst entertainment, leisure and services industries are suffering greatly, industries like energy and many digital technologies in areas like cybersecurity and health care, have been in increasing demand. If you are not sure which direction to go in, whether that’s a new job, or expanding or starting a business, we’ve explored some of the UK’s fasted growing industries.

What industries are growing in the UK?

Renewable energy

With lockdowns, reduced industry activity and travel restrictions, the demand for oil, gas and coal have all fell in 2020. Though the renewable energy sector has taken a hit, it has so far demonstrated resilience in the face of COVID-19. According to Ember, energy from renewable sources made up 42% of the UK’s electricity last year compared with 41% generated from gas and coal plants together. In contrast, electricity from gas-fired power plants fell to a five-year low of 37% of the UK’s electricity, while coal power plants made up just 2% of the electricity mix.

Offshore wind is where the UK sees most success. The country is the world leader in the industry, with more capacity installed that any other country. The UK is home to 42% of Europe’s 25GW offshore wind capacity. As a result, the cost of new offshore wind has fallen by 50% since 2015 and it is now one of the lowest cost options for new power in the UK – cheaper than new gas and nuclear power.

The UK government is also investing heavily in renewable energy. Its 10-point plan is seeing £12bn being spent on investment in the sector to help create jobs, decarbonise the economy and encourage innovation in technology.

Cybersecurity

When it comes to looking at what industries are growing in the UK, Cybersecurity has pretty much always been high on the list. As we have come to rely more and more on digital tools for work and home life, our data becomes increasingly susceptible to hacking. Google have said, since the pandemic they are blocking 100 million phishing emails a day. Covid-19 has proven to be one of the biggest threats to cybersecurity. Before the first lockdown, in the UK attacks targeting people working from home made up just 12% of malicious emails. That figure rose to 60% just six weeks later.

The high demand is reflected by the increased investment in the sector. A new report found 2020 saw a record year for cybersecurity, which is now worth £8.9 billion. There’s also been a record of £800m of investment raised by firms across 73 deals – more than twice that raised in 2019. A new report also found almost 50,000 people are now employed in UK cybersecurity. Plus, the number of active cybersecurity firms in the UK increased 21 per cent on last year. It also contributed over £4bn to the economy in this period, an increase of 6%. That’s some serious growth.

FinTech

The pandemic has accelerated the demand for the digital services industry as people became forced to integrate COVID-19 friendly payment methods. As cash was considered risky, online transactions soared. And this looks set to continue into 2021, as investment in mobile and contactless services won’t be limited to larger organisations, but available for smaller business to help facilitate digital payments.

Currently, the UK is the third largest destination for FinTech investment, after the United States and China. The sector in the UK is comprised of over 1,600 firms, and that number is projected to double by 2030. The sector also contributes a whopping £7 bn and over 60,000 jobs to the UK economy.

A further boost to the sector looks set to come this year. as the upper limits of payments may be increased from £45 to £100, making contactless an even more appealing option for many business and customers. This is likely to increase focus on the integration of mobile loyalty cards into these services too.

Further to this, last year saw a rise in by now, pay later (BNPL) apps as consumers online shopped. Online purchases using buy now pay later services are growing at a rate of 39% a year, with market share set to double by 2023.

E-commerce

High street shops have suffered drastically. Lockdown meant they have had to close for substantial periods, and when they’ve been open, the use of changing room is prohibited. Which has mean, whilst people have been unable to take to the shops, ecommerce has boomed.

Even before COVID-19, the sector had been growing steadily year-on-year. In the first quarter of 2010, only 6.8% of sales in retail were made online – five years later in the first quarter of 2015, that shot to 12%.

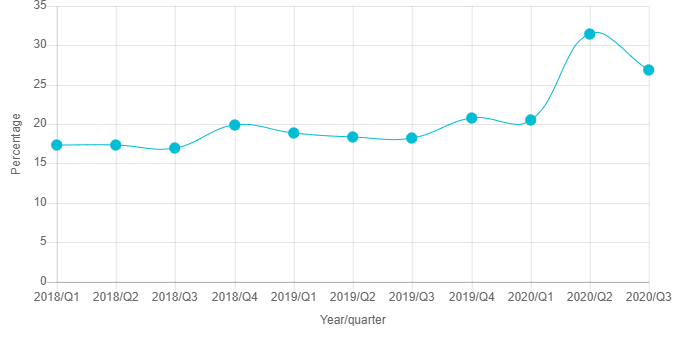

Just before the pandemic took hold in Europe, 20.5% of all UK sales in retail were made online in the first quarter of 2020. This led to a spike of 31.4% in the second quarter of the year following the first nationwide lockdown in March. But this fell to 26.9% in the third quarter of 2020, coinciding with the re-opening of non-essential shops.

The graph illustrates the spike in 2020, at the time of the start of the pandemic.

Source: Mobile Transaction

2020 has seen a major shift in people’s buying habits. In a survey by Wunderman Thompson, they reported 51% of people said they would retain some of their new purchasing behaviours as a consequence of COVID-19. And just 16% said that they intended to return to their old shopping habits. Further to this, 38% of consumers say that they are now more comfortable with digital technology than before lockdown.

Gaming

The gaming industry is already rapidly growing, but the pandemic certainly helped accelerate this. As the live sports industry took a massive hit due to restrictions, the virtual gaming world has exponentially grown. The UK games market exceeded £4bn for the first time in 2020. Revenues were £4.2bn, up 14.5% on 2019.

As the country went into lockdown, video game downloads soared. The Entertainment Retail Association said the largest single segment of the games market is the digital games business, which includes everything from mobile and streamed games to downloads. It grew by 16.3% to £3.6bn in 2020, driven by increasing numbers of gamers buying direct to console games, digital subscriptions and downloadable content. The digital games market in the UK grew so much in 2020, it was worth more than the video market and two times as much as the music market.

Despite lockdowns on the high street, physical games grew 2020 with revenues up 4.6% to £598.5m. Increased game purchasing during lockdown as well as new gaming consoles in November are the reason behind this growth, according to the ERA.